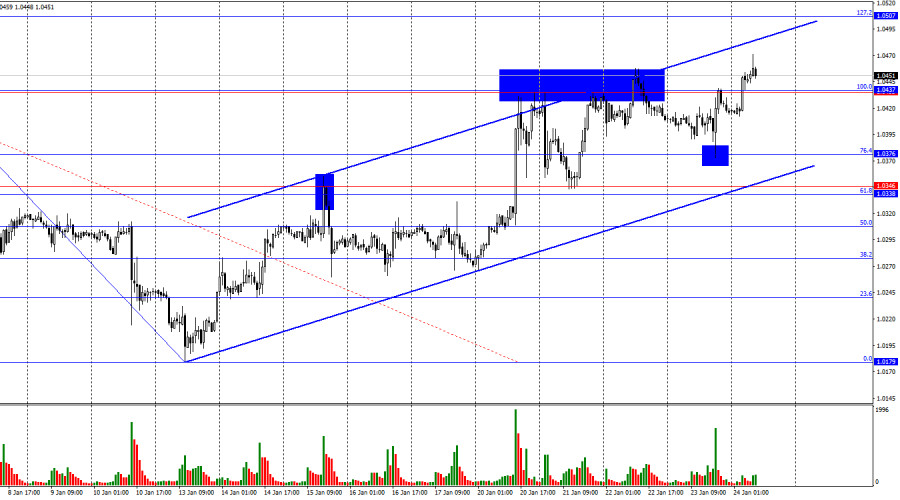

On Thursday, the EUR/USD pair rebounded from the 76.4% Fibonacci corrective level at 1.0376, reversed in favor of the euro, and secured above the 100.0% Fibonacci level at 1.0437. This indicates that the upward movement may continue toward the next corrective level of 127.2% at 1.0507. The upward trend channel continues to signal a bullish market sentiment. A decline in the euro seems unlikely in the near term.

The wave structure remains clear. The last completed downward wave broke the low of the previous wave, while the current upward wave has yet to surpass its previous peak. This indicates that the bearish trend is still ongoing, with no signs of a reversal. For a trend reversal to occur, the euro must rise confidently above the 1.0460 level and close above it within the current wave. This could happen as soon as today.

The economic calendar on Thursday was relatively quiet. However, Donald Trump made headlines once again with his speech at the Davos International Forum, where he delivered several bold statements. While not all of his claims are likely to materialize, his remarks often influence the market. The U.S. president stated that he will demand monetary policy easing from the Federal Reserve.

It's worth noting that Trump previously pressured the Fed during his first term, arguing that high interest rates make the dollar "too strong," which hinders U.S. exports. At the time, Fed Chair Jerome Powell resisted Trump's demands. Today, Powell remains at the helm, and it is unlikely that Trump will succeed in influencing him. Therefore, I do not expect the FOMC to cut rates in 2025 beyond what it has already planned, or beyond what inflation allows. Nonetheless, Trump's remarks prompted selling pressure on the dollar.

On the 4-hour chart, the pair has risen to the 127.2% Fibonacci corrective level at 1.0436 and secured above it. This suggests that the upward movement may continue toward the next Fibonacci level of 100.0% at 1.0603. Furthermore, the euro has broken above the downward trend channel, signaling a gradual shift to a bullish trend. However, the duration of this bullish trend remains uncertain.

Commitments of Traders (COT) Report

During the last reporting week, speculators closed 3,743 long positions and 7,470 short positions. The sentiment among the "Non-commercial" group remains bearish, indicating a potential further decline for the pair. The total number of long positions held by speculators now stands at 162,000, while short positions total 223,000.

For 18 consecutive weeks, major players have been offloading the euro. This confirms a bearish trend without any exceptions. Occasionally, bulls dominate within certain weeks, but these instances are exceptions rather than the rule. The main driver for the dollar's decline—expectations of FOMC monetary policy easing—has already been priced in, leaving the market with little reason to sell the dollar further. However, new reasons may emerge soon, potentially even this week. For now, the rise of the U.S. dollar appears more probable. Graphical analysis also supports the continuation of the long-term bearish trend, suggesting further declines in the EUR/USD pair.

Economic Calendar for the EU and the US:

- EU: German Services PMI (08:30 UTC)

- EU: German Manufacturing PMI (08:30 UTC)

- EU: Eurozone Services PMI (09:00 UTC)

- EU: Eurozone Manufacturing PMI (09:00 UTC)

- US: Services PMI (14:45 UTC)

- US: Manufacturing PMI (14:45 UTC)

- US: New Home Sales (15:00 UTC)

- US: Consumer Sentiment Index (15:00 UTC)

The economic calendar for January 24 is packed with entries, mostly focused on business activity data. The impact of the news background on market sentiment may be moderate and could manifest at various times throughout the day.

Forecast for EUR/USD and Trading Recommendations

Selling opportunities may arise if the pair consolidates below the upward trend channel on the hourly chart. Currently, there is a high probability of a bullish trend reversal. Buying opportunities were present after a rebound from the 1.0336–1.0346 zone with targets at 1.0435–1.0448, which have already been achieved. New buying opportunities may arise after further rebounds or consolidations on the hourly chart.

Fibonacci levels are plotted at 1.0437–1.0179 on the hourly chart and 1.0603–1.1214 on the 4-hour chart.