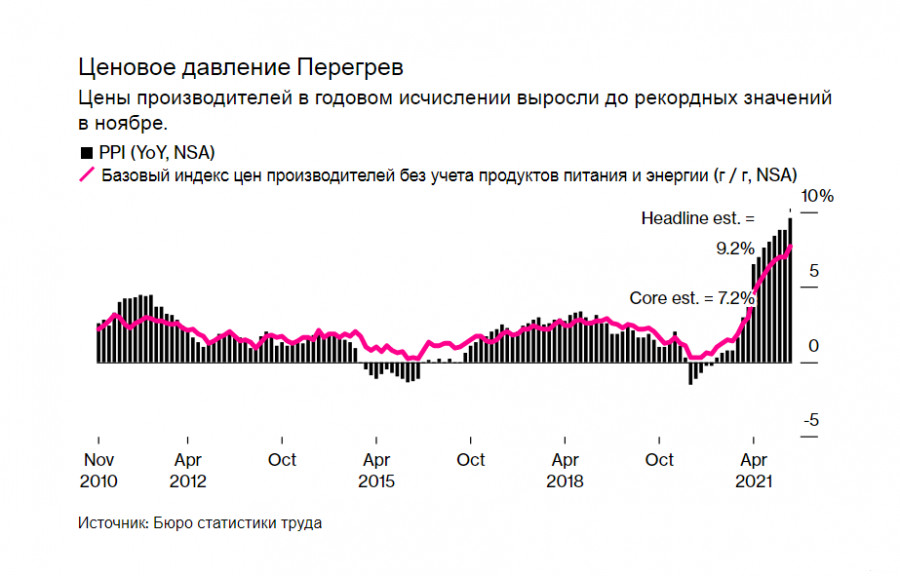

In November, US factory prices showed a record yearly rise of nearly 10%. This surge is likely to maintain inflationary pressure until the spring of 2022.

Released inflation data undermine US market

According to the Labor Department, on Tuesday the retail sector's producer price index rose by 9.6% as compared to a year earlier and by 0.8% than the previous month. Both figures exceeded economists' forecasts.

Notably, the report records changes in prices paid to manufacturers as well as in profits earned by wholesalers and retailers.

The average annual increase was the largest since 2010.

The core price index (excluding food and energy costs) went up 0.7% (monthly increase) and added a record 7.7% as compared to last year.

Prices for services also increased last month.

The cost of materials has risen rapidly this year due to disruptions in delivery plans, a resurgence in demand and labor shortages. Many businesses have used the strategy of transferring these additional costs to customers owing to price increases. Besides, the latest report indicates additional consumer price increases in the coming months.

Consumer inflation

Data released last week showed that the consumer price index rose by 6.8% last month compared to a year earlier, the fastest annual rate in nearly 40 years.

While inflation was initially concentrated in a few categories related to the economic recovery, in particular services and construction, it has now expanded to almost all segments of the national economy.

A larger-than-expected sustained rise in inflation is likely to force policy makers to act. Analysts expect the Fed to accelerate the tapering of its bond-buying program at its last meeting of the year on Wednesday, allowing the central bank to begin raising interest rates as soon as next year.

On average, a survey of economists showed that they believe the central bank will raise interest rates from nearly 0 to 0.25-0.50% in the third quarter of next year and then again in the fourth quarter.

Senior research analyst at FXTM Lukman Otunuga wrote in a note to a client that the central bank intended to announce an acceleration of gradual easing starting in January 2022, with the consensus expecting rates to double to counter inflation.

He added that traders estimated at least one rate hike with a 73% probability by early May 2022 and a full 25 basis point hike by mid-June 2022.

The persistence of inflation in recent months has proven to be a serious political problem for President Biden's administration. The US President is still relying on his roughly $2 trillion tax and spending plan. According to other senators, such as popular Joe Manchin of West Virginia, the package is further stimulating price increases. Certainly, as far as a cheap dollar is concerned, this is to be expected.

Producer prices apart from food, energy and trade services, an indicator often favored by economists as it excludes the most volatile components, increased by 0.7% compared to the previous month. The figure went up a record 6.9% compared with last year.

Commodity prices rose by 1.2% in November compared to a month earlier, indicating significant growth, including scrap ferrous metals, gasoline, fruits and vegetables.

Services costs added 0.7%, partly due to a jump in investment services prices that was triggered by all the major prime brokers.

Intermediate-demand semi-finished goods costs, which reflect prices in the production pipeline, went up 1.5% compared to a month earlier. The figure increased by 26.5% compared to a year earlier, the highest reading since 1974.

Markets react

Stock index futures increased their losses as data bolstered expectations that Federal Reserve policymakers will tighten monetary policy next year.

A rapidly spreading coronavirus variant Omicron also dampened sentiment after the S&P 500 Index hit a record closing high late last week.

Shares of Megacap in the technology and communications sector, including Meta Platforms, Microsoft Corp, Tesla Inc, Alphabet Inc and Amazon.com Inc, fell from 0.6% to 2% at the premarket.

Investment markets specialist Tom Martin said that people were trying to create an environment to slow the spread or severity of (Omicron), however healthy people wanted to participate in the economy.

He noted that investors fancied taking a neutral position for the rest of the year as they did not want to trade much in between until something occurred.

Apple Inc. fell by 0.2%, the smallest drop among its rivals. The company continued to try to become the world's first $3 trillion market cap company and is a further good safe haven within the high-tech sector.

At 8:39 am ET, Dow e-minis shares were down 0.19%, S&P 500 e-minis lost 23 points (-0.49%), and Nasdaq 100 e-minis dropped by 149.25 points (-0.93%).

Shares of software companies Datadog, Akamai Tech and Cloudflare declined 3-6% after JPMorgan downgraded shares in the sector.