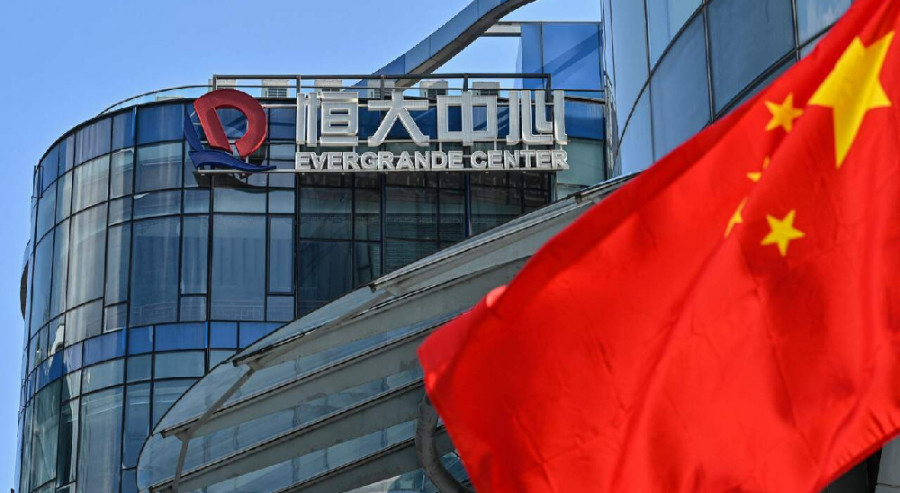

The crisis in the real estate market of China continues to gain momentum. After the shares and bonds of the Chinese developer, Shimao Group fell sharply on Tuesday due to news of restructuring and overestimation of assets being sold, a new blow. Today, China Evergrande Group, the largest housing developer in the industry, was officially declared a default by the credit rating agency S&P Global. The announcement was published on Friday immediately after it became known that the overgrown firm missed a bond payment earlier this month.

It has begun: the largest Chinese developer Evergrande has been assigned a default rating

"According to our estimates, China Evergrande Group and its offshore financial division Tianji Holding Ltd. They were unable to pay coupon payments on their issued senior bonds in US dollars," S&P said in a statement.

S&P representatives add that Evergrande's management asked to raise the ratings after publication and designate their position as a "selective default" (a term that rating firms use to describe a missed payment on a bond, but not necessarily for all of its bonds).

At the same time, the rating representatives note that "Evergrande, Tianji, or the trustee did not make any statements or confirmations to us about the status of coupon payments." Thus, the desire to revise the ratings is not based on anything.

Now this news falls on the general background as unsuccessfully as possible. Even this spring, in the wake of the rise of the markets, China could afford even very large bankruptcies. But in the case of Archegos and other bankrupt investors who went down the drain a year earlier, this happened inside the financial sector, with little impact on the real economy.

The bankruptcy of a developer who insures against risks with real estate - the most stable asset of all time, is a completely different conversation. People who invested in apartments will not receive them now. Builders will be out of work. Loans to banks will not be paid, and someone else will not get their loan.

In 2008, the crisis began with the fact that housing prices began to fall, forcing banks to demand additional collateral from developers. A rollback of only 1-2% of the cost was enough to bankrupt the largest US mortgage company Lehman Brothers. We all know what it led to.

Now the markets are more than calm. The hype in the real estate market pushes prices up due to the opportunity to hedge the risks of inflation by buying real estate. Therefore, it may seem insignificant to analysts to lose one, albeit a large, industry player.

But let me remind you that last time the US government lowered interest rates to support the economy, and thereby saved the situation. Alas, this method has exhausted itself this year. The increase in the national debt cannot continue indefinitely.

However, this time the scenario may be completely different.

Bankruptcy against the background of inflation and production downtime due to coronavirus, only one large developer risks launching a cascade of bankruptcies, because the risk increases that people will stop paying for mortgages due to financial circumstances complicated by rising prices and downtime. Now it is difficult to assess how high the probability of a critical accumulation of a mass of outstanding loans is in the PRC, where such issues can be resolved quite harshly, and the debts of parents are usually inherited by children.

However, now an outbreak of coronavirus is raging in the largest manufacturing province, which the authorities are not yet able to suppress following the Covid Zero policy. Many enterprises have been quarantined, and it is unlikely that workers are paid for downtime. In addition, taking into account the news from the Shimao Group, it can be assumed that turbulence is occurring in the Chinese real estate sector, which is not visible under the surface of the political sea.

As a result, the population of China is getting poorer with each outbreak of the virus, just like the population of any other country where the epidemic is raging. The inability to pay interest on loans can undermine not only mortgage lending, but also financial stability in general. We should never forget about this factor. The Great Depression also began with a series of minor bankruptcies. The combination of inflation and a pandemic can play the worst joke on us in the last hundred years.

However, the developer still has the opportunity to repay the obligations, probably with the help of government subsidies. In the meantime, this news will seriously undermine Asian indices in the next session, forcing investors to doubt the yuan as a safe-haven.