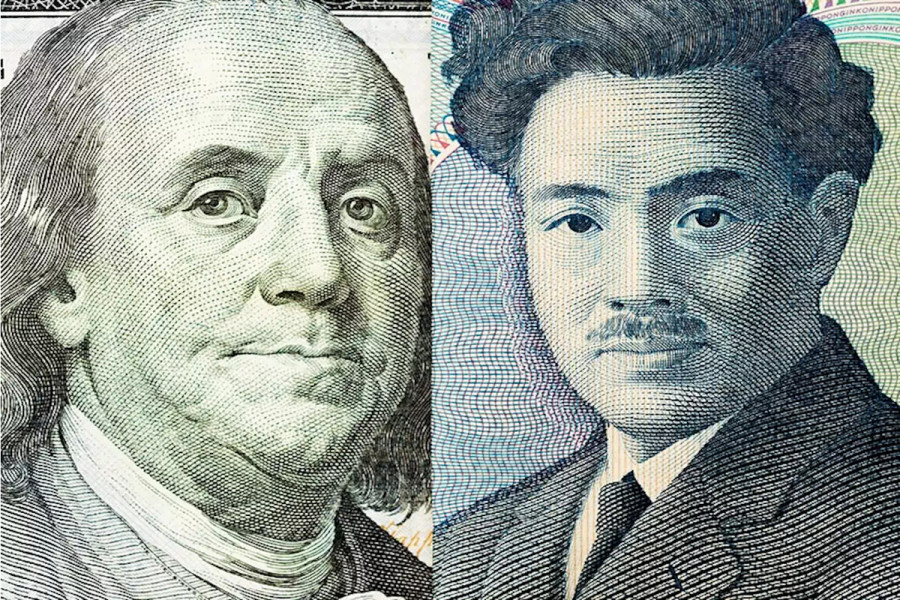

Driven by the rise in US Treasury yields, the US dollar continues to strengthen across the board, with the yen being hurt the most. While the current depreciation of the Japanese currency is limited by the risk of currency intervention by Tokyo, analysts are confident that the ongoing rally of the USD/JPY pair is set to continue.

Dollar's strong ground

Yesterday, the greenback extended its 5-day broad-based rally. By the end of Tuesday's trading, it surged by more than 0.2% against its main rivals, hitting a new 10-month high of 106.26.

Against the yen, the dollar appreciated by 0.13%, settling above the significant mark of 149.00. On an intraday chart, the pair hit 149.18, its highest level in 11 months.

In recent days, the primary catalyst for the US dollar's rally has been the rise in the yields of 10-year US Treasury bonds.

Last Monday, the yield dramatically soared to a 16-year high of 4.5660%. This surge was attributed to investors' hawkish sentiments concerning the Federal Reserve's forthcoming monetary strategies.

Last week during the FOMC meeting, the regulator decided to maintain interest rates within their current range.

Nevertheless, the Federal Reserve made it clear that it has no plans of winding down its anti-inflation campaign at this point. This is because the price growth remains robust, and a resilient economy favors further tightening.

The revelation that FOMC members are seriously considering another rate hike this year stunned the market. Many traders were confident that the Fed's rhetoric at the September meeting would be restrained and neutral. Instead, it was clearly hawkish. Analyst Tina Ten commented, "I'm now confident that the regulator will execute its intentions, leading us to witness higher rates."

This week, traders' confidence in the Fed's continued tightening has solidified primarily due to separate comments from FOMC members.

On Monday, several US officials, including Austan Goolsbee, Susan Collins, and Mary Daly, emphasized the need for ongoing combat against sticky inflation. Yesterday, they were joined in this sentiment by the head of the Minneapolis Federal Reserve, Neel Kashkari.

The politician does not rule out the possibility that the Fed might need to significantly increase the key rate to conclusively bid farewell to high inflationary pressures.

Considering the prevailing hawkish stance within the Federal Reserve, the majority of market participants believe that this week Fed Chairman Jerome Powell will endorse his colleagues' views, potentially providing a fresh boost to the US dollar.

Chairman Powell is scheduled to speak on Thursday, September 28. It is anticipated that he will address the audience following the publication of US GDP data.

Currently, economists are projecting the US economy's growth to inch up from 2.0% to 2.2% in the second quarter. If these figures surpass preliminary estimates, it might spur Powell to make more assertive policy statements.

In such a scenario, the US dollar is poised to showcase a rocketing rise across all fronts, including against the yen.

Some analysts firmly believe that the overtly hawkish rhetoric of the Fed's chairman will outweigh traders' fears of currency intervention by Tokyo. As a result, the USD/JPY asset is predicted to surpass the psychologically critical threshold of 150 in the foreseeable future.

Yen's shaky ground

For many market participants, the 150 mark is viewed as the so-called 'red line'. They argue that reaching this level would prompt the Japanese government to conduct its first yen-purchasing intervention of the year.

For reference, in 2022, Tokyo intervened twice in the market to bolster its currency. A staggering sum of over $60 billion was allocated for this purpose.

Given that Japan's currency reserves rank among the world's largest, a continued sharp drop in the yen might prompt Tokyo to dip into its coffers once more.

A large-scale intervention would likely cause a sharp drop in the USD/JPY pair, but the asset is unlikely to stay at its lows for long, judging by its trajectory from the previous year.

The impact of the two intervention rounds a year ago was fleeting. And given that the current fundamental backdrop still favors the US dollar, it is plausible that history might repeat itself.

Analysts at Commerzbank think that "an intervention at this stage is unlikely to have a significant effect. Given that the Bank of Japan remains reluctant to abandon its ultra-loose monetary policy, a weakening yen is fundamentally justified. A weaker US dollar would be beneficial for the yen, but at the moment, no grounds for such a shift exist. A robust US economy combined with the Federal Reserve's hawkish tendencies supports the greenback and is likely to drive USD/JPY upwards."

It is worth noting that the Bank of Japan also held a monetary policy meeting last week. The outcome witnessed the regulator maintaining its status quo and signaling a continued dovish stance until the country's inflation becomes stable.

Earlier this week, BOJ Governor Kazuo Ueda reinforced this dovish rhetoric, stating that the central bank is still far from achieving its target of a stable 2% inflation. He emphasized the need for prolonged stimulus, effectively quashing market speculations about the Bank of Japan's imminent capitulation.

Apparently, the divergence in monetary perspectives between the BOJ and the Federal Reserve, which last year resulted in the JPY depreciating against the dollar to a 32-year low, remains in play and poses significant risks for the yen.

Regardless of the efforts made by the Japanese government to strengthen its currency (be it verbal interventions or actual market engagements), JPY stands little chance of achieving serious and lasting strength against the dollar unless both regulators initiate a monetary U-turn.

Technical outlook

From a technical viewpoint, the USD/JPY pair is aiming to test the key level of 150.00 in the short term. If it breaches this threshold, the next resistance to watch is the October 21st high of 151.94, followed by the 152.00 level.

On the flip side, if the pair drops below the Tenkan-Sen line at 148.10, it will expose the recent low registered at 144.44. However, on their way down, bears may face obstacles at such key support levels as the Kijun-Sen around 146.82 and the psychologically significant level of 145.00.