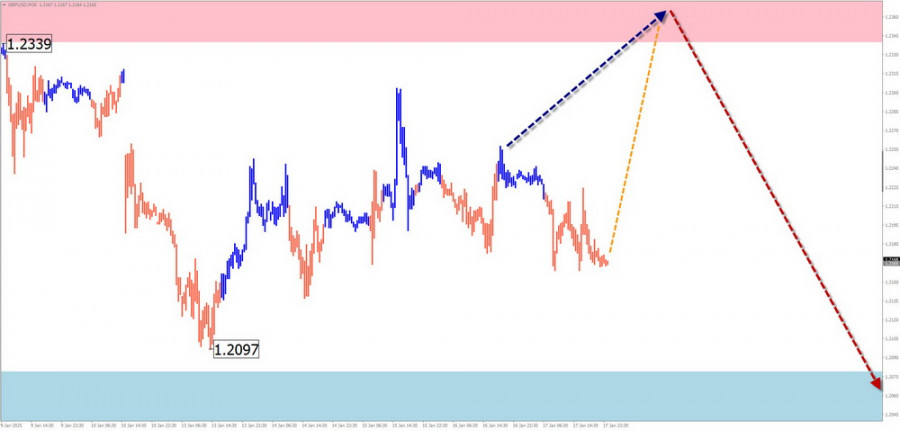

GBP/USD

Analysis:The latest wave structure for GBP/USD, initiated in August last year, remains incomplete and is descending. This section serves as a correction within a larger wave. Over the past week, the pair has been forming an intermediate pullback.

Forecast:This week, GBP/USD is likely to continue moving sideways within a flat pattern. A brief rise toward resistance is possible in the early days, followed by a reversal and a downward movement. Volatility is expected to increase toward the weekend.

Potential Reversal Zones:

- Resistance: 1.2340–1.2390

- Support: 1.2080–1.2030

Recommendations:

- Buy: Limited potential and high risk.

- Sell: Consider trades after reversal signals near the resistance zone are confirmed by your trading systems (TS).

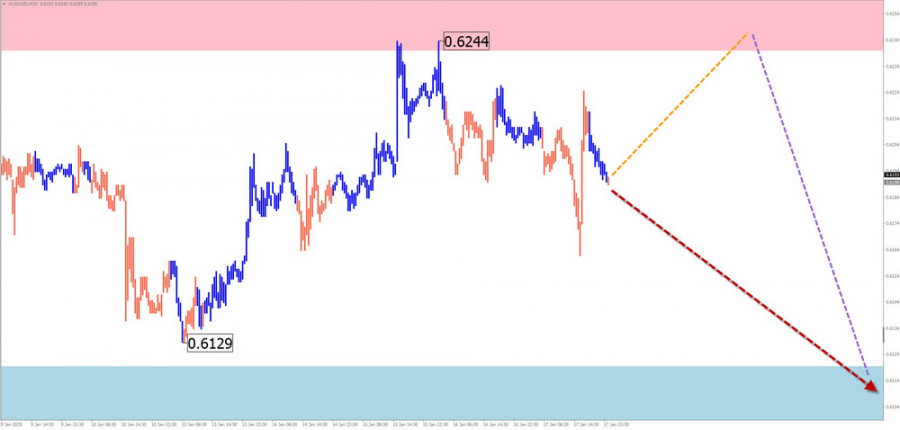

AUD/USD

Analysis:The descending wave for AUD/USD, starting September 30 last year, has brought prices to a significant potential reversal zone. Over the past month, the wave has formed a flat correction in the form of a shifting flat structure, which remains incomplete.

Forecast:The pair is expected to continue its sideways movement this week. After potential pressure on the resistance zone, a reversal and a downward move toward support are likely.

Potential Reversal Zones:

- Resistance: 0.6240–0.6290

- Support: 0.6120–0.6070

Recommendations:

- Buy: High risk, may result in losses.

- Sell: Premature without confirmed reversal signals near resistance.

USD/CHF

Analysis:The short-term direction for USD/CHF has been defined by an upward wave since August last year, which remains incomplete. The wave scale exceeds the H4 timeframe, and the price has breached an intermediate resistance zone. A correction appears necessary.

Forecast:In the early days of the week, expect sideways movement with possible pressure on the lower boundary of the support zone. Later, a reversal and upward continuation are likely, with resistance at the lower edge of the wave's preliminary target zone.

Potential Reversal Zones:

- Resistance: 0.9290–0.9340

- Support: 0.9130–0.9080

Recommendations:

- Sell: No potential and high risk.

- Buy: Consider after confirmed reversal signals within the support zone.

EUR/JPY

Analysis:Since late December, EUR/JPY has been forming a descending wave, correcting the latest section of the global trend. The wave forms a stretched flat structure and remains incomplete.

Forecast:Expect overall sideways movement this week. After potential pressure on the resistance zone, a reversal and downward continuation are likely. The calculated support lies at the upper boundary of the wave's preliminary target zone.

Potential Reversal Zones:

- Resistance: 161.00–161.50

- Support: 159.20–158.70

Recommendations:

- Buy: Limited potential and high risk.

- Sell: Becomes viable after confirmed reversal signals in the resistance zone.

EUR/CHF

Analysis:Since late November, EUR/CHF has been trending upward. The latest, incomplete wave segment is downward, serving as a correction within the broader uptrend.

Forecast:In the next few days, expect sideways movement or a brief dip, but not below the calculated support. A continuation of the upward move is more likely by the end of the week. The calculated resistance aligns with the lower boundary of the preliminary target zone.

Potential Reversal Zones:

- Resistance: 0.9440–0.9490

- Support: 0.9370–0.9320

Recommendations:

- Sell: High risk and may result in losses.

- Buy: Consider trades after confirmed reversal signals in the support zone.

US Dollar Index

Analysis:After a period of steady growth, the USD Index is undergoing a correction. The wave began at the start of the year and remains incomplete, forming a shifting flat structure. The preliminary target zone aligns with a significant support level on the largest timeframe.

Forecast:Early in the week, expect sideways movement along the support zone. Increased volatility, a reversal, and a resumption of the dollar's uptrend are likely by the week's end.

Potential Reversal Zones:

- Resistance: 109.80–110.00

- Support: 108.70–108.50

Recommendations:

- Sell: Risky, with limited potential for dollar weakening.

- Buy: Weakness in major currency pairs against the dollar offers profitable opportunities.

Notes on Simplified Wave Analysis (SWA):

- All waves in SWA consist of three parts (A-B-C). The analysis focuses on the last, incomplete wave on each timeframe.

- Dotted lines indicate expected movements.

- Caution: Wave algorithms do not account for the duration of price movements over time.