Analysis of Trades and GBP/USD Trading Tips

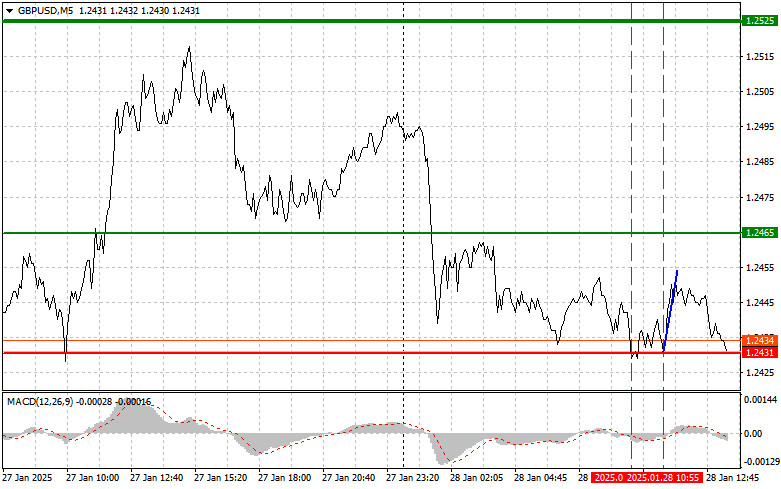

The test of the 1.2431 level occurred when the MACD indicator had moved significantly below the zero mark, which clearly limited the pair's downward potential. For this reason, I did not sell the pound. Shortly afterward, another test of 1.2431 occurred while the MACD was in the oversold zone and rebounding, which allowed Scenario #2 for buying to unfold. This led to a 15-point rise in the pair, after which buyers left the market.

Currently, markets are filled with anticipation, and investors are closely monitoring upcoming data releases. US Consumer Confidence, long considered a key indicator of consumer sentiment and willingness to spend, will be one of the focal points. A high confidence level could indicate an increase in consumer spending, which positively impacts the economy and supports the US dollar.

Another key indicator is the Change in Durable Goods Orders, which signals recovery in manufacturing activity and business optimism. Whether it will serve as a positive signal for economic growth depends on its trajectory and comparison with previous reports.

The Richmond Fed Manufacturing Index reflects the state of the manufacturing sector in the heart of the US. An increase in this index may suggest that industrial enterprises are gaining confidence, which would positively affect the broader economy.

Lastly, the House Price Index, also set to be released, serves as a measure of market stability. Factors affecting housing demand and supply continue to shape household loans and spending, making this indicator critical for analysis.

As for the intraday strategy, I will primarily focus on implementing Scenario #1 and Scenario #2.

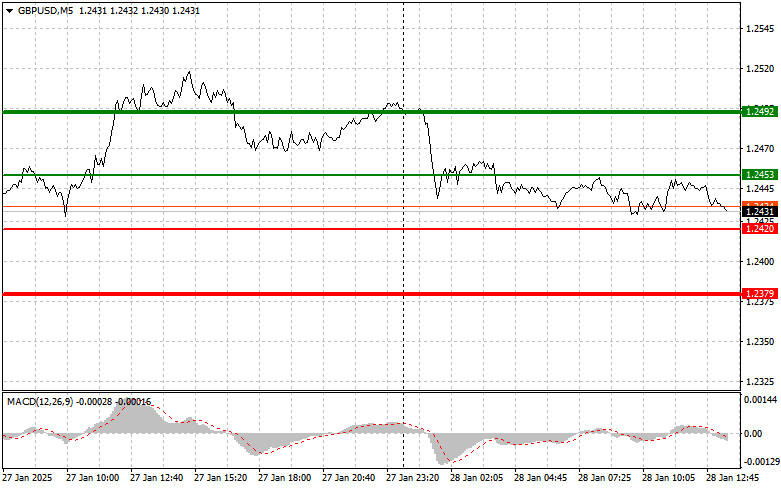

Buy Signal

Scenario #1: I plan to buy the pound today when it reaches the 1.2453 level (green line on the chart), with a target of 1.2492 (thicker green line on the chart). At the 1.2492 level, I plan to exit the purchases and open short positions in the opposite direction, aiming for a 30–35 point movement downward. The pound's growth today may continue in line with the uptrend but will depend on weak US data.Important: Before buying, ensure the MACD indicator is above the zero mark and just starting to rise.

Scenario #2: I also plan to buy the pound today if there are two consecutive tests of the 1.2420 level, with the MACD in the oversold zone. This will limit the pair's downward potential and lead to a reversal upward. Expect growth to the opposite levels of 1.2453 and 1.2492.

Sell Signal

Scenario #1: I plan to sell the pound today after a breakout of the 1.2420 level (red line on the chart), which will lead to a quick decline in the pair. The key target for sellers will be 1.2379, where I will exit sales and immediately open long positions in the opposite direction, aiming for a 20–25 pip movement upward. Sellers are expected to take action if US statistics come in strong.Important: Before selling, ensure the MACD indicator is below the zero mark and just starting to fall.

Scenario #2: I also plan to sell the pound today if there are two consecutive tests of the 1.2453 level, with the MACD in the overbought zone. This will limit the pair's upward potential and lead to a reversal downward. Expect a decline to the opposite levels of 1.2420 and 1.2379.

Chart Key:

- Thin Green Line: Entry price for buying the instrument.

- Thick Green Line: Estimated price where Take Profit can be set, as further growth above this level is unlikely.

- Thin Red Line: Entry price for selling the instrument.

- Thick Red Line: Estimated price where Take Profit can be set, as further decline below this level is unlikely.

- MACD Indicator: Pay attention to overbought and oversold zones when entering the market.

Important: Beginner Forex traders must be cautious when making market entry decisions. Before the release of critical fundamental reports, it is best to stay out of the market to avoid sharp price fluctuations. If you decide to trade during news releases, always set Stop Loss orders to minimize losses. Without Stop Losses, you can quickly lose your entire deposit, especially when trading large volumes without proper money management.

And remember: for successful trading, it is essential to have a clear trading plan, like the one provided above. Making spontaneous trading decisions based on the current market situation is a losing strategy for intraday traders.