Analysis of Trades and Trading Tips for the British Pound

Amid growing economic risks stemming from unpredictable trade policies, traders are reassessing their strategies. The British pound, already vulnerable due to internal economic challenges, has become even more susceptible to fluctuations early this year. Traders have shifted their focus to more stable assets like gold and the US dollar, leading to capital outflows from the sterling. The situation is worsened by UK economic indicators that show slowed growth, which creates additional challenges for the Bank of England and may limit its ability to maneuver. Anticipated discussions about future interest rates also contribute to instability in the forex market. Trade uncertainty and geopolitical factors will continue to be central concerns for traders focused on the pound. As a result, further volatility can be expected in the coming days as the pound faces challenges against the US dollar.

This morning, data on changes in the M4 money supply aggregate and the number of approved mortgage applications in the UK will be released. These indicators play a crucial role in assessing the country's economic health, as they reflect liquidity levels and access to credit for the public. Changes in the M4 money supply, which includes both cash and non-cash assets, may indicate how the central bank will respond to economic challenges. An increase in the money supply often suggests efforts to stimulate economic activity, whereas a decrease may signal caution in the face of uncertainty. Additionally, the number of approved mortgage applications serves as a key indicator of the housing market's condition. Growth in this metric can reflect increased consumer confidence and interest in home buying, which could contribute to economic growth.

For intraday strategy, I will focus on implementing Scenarios #1 and #2.

Buy Signal

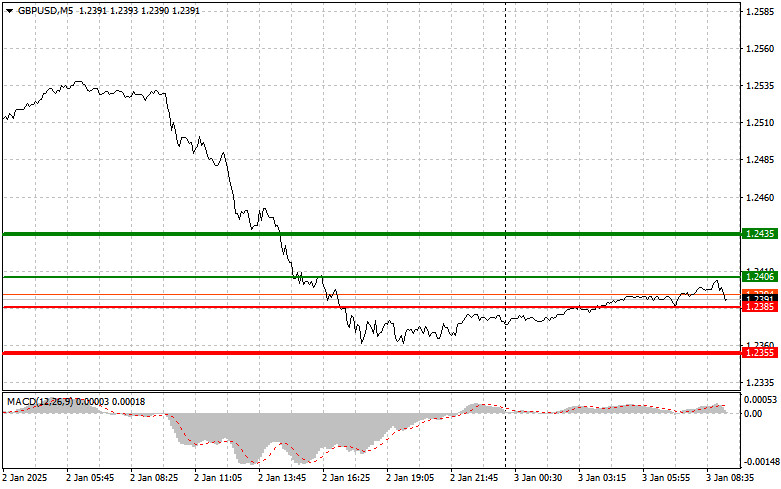

Scenario #1: Today, I plan to buy the pound at an entry point around 1.2406 (green line on the chart), targeting growth to 1.2435 (thicker green line on the chart). Around 1.2435, I will exit the purchase and open short positions for a potential 30–35 pip movement in the opposite direction. The rise of the pound today is likely only within the correction framework. Important! Before buying, ensure that the MACD indicator is above the zero mark and beginning to rise.

Scenario #2: I also plan to buy the pound today if there are two consecutive tests of the 1.2385 price level when the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to an upward market reversal. Growth to the opposing levels of 1.2406 and 1.2435 can be expected.

Sell Signal

Scenario #1: I plan to sell the pound after breaking below the 1.2385 level (red line on the chart), which will likely lead to a quick decline in the pair. The key target for sellers will be 1.2355, where I will exit the short position and immediately buy in the opposite direction, expecting a 20–25 pip upward movement from that level. Selling the pound is more favorable at higher levels in anticipation of a renewed downward trend. Important! Before selling, ensure that the MACD indicator is below the zero mark and beginning to decline.

Scenario #2: I also plan to sell the pound today in the case of two consecutive tests of the 1.2406 price level when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. A decline to the opposing levels of 1.2385 and 1.2355 can be expected.

Chart Notes

- Thin green line: Entry price for buying the trading instrument.

- Thick green line: A suggested target for Take Profit or manually locking in profits, as further growth above this level is unlikely.

- Thin red line: Entry price for selling the trading instrument.

- Thick red line: A suggested target for Take Profit or manually locking in profits, as further decline below this level is unlikely.

- MACD Indicator: Critical for identifying overbought and oversold zones to guide market entry decisions.

Important Note for Beginner Traders

- Always approach market entry decisions cautiously.

- Avoid trading during major news releases to sidestep volatile price swings.

- If trading during news releases, always set stop-loss orders to minimize losses.

- Trading without stop-loss orders or money management practices can quickly deplete your deposit, especially when using large volumes.

- A clear trading plan, like the one outlined above, is essential for successful trading. Spontaneous trading decisions based on current market conditions are inherently disadvantageous for intraday traders.