Analysis of Trades and Trading Advice for the Euro

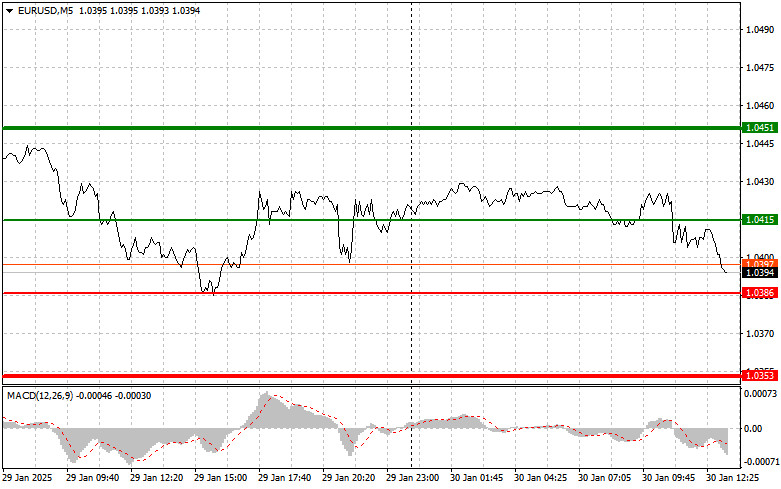

The test of 1.0414 occurred just as the MACD indicator began moving downward from the zero mark, confirming a valid selling entry point for the euro in line with the ongoing downtrend. As a result, the pair fell by 20 points.

Weak GDP growth data for the eurozone in Q4 2024 has renewed pressure on the euro. The ECB remains highly concerned about economic weakness, which raises the likelihood of further rate cuts, a bearish factor for the euro.

Additionally, the slowdown in economic growth raises concerns about the euro's stability and inflation levels. The ECB faces a dilemma—the need to stimulate the economy while balancing the risks of euro depreciation and rising inflation. Rate cuts in a weak economic environment could lead to further debt burdens on countries with already high debt levels and undermine confidence in the euro.

The importance of the U.S. GDP report scheduled for release later today should not be underestimated, as it not only reflects the current state of the economy but also influences investor expectations. If the data exceeds forecasts, it could drive traders toward new dollar purchases, which in turn would weaken the euro.

The number of initial jobless claims will also impact market sentiment. A rise in this indicator could spark fears of a slowdown in the economic recovery, which would negatively affect the U.S. dollar. In such a scenario, investors might shift to less risky assets, making labor market indicators crucial for market direction.

Ultimately, the combination of GDP data and unemployment figures could become a key driver of currency fluctuations in the near term.

Intraday Strategy

For today's trading, I will focus on executing Scenario #1 and Scenario #2 as primary strategies.

Buy Signal

Scenario #1: Buying the euro (EUR/USD) today is possible if the price reaches around 1.0415 (green line on the chart), with a target of 1.0451. At 1.0451, I plan to exit the market and sell the euro in the opposite direction, expecting a 30-35 point movement from the entry point. Euro strength today is likely only if U.S. data comes in weaker than expected.

Important: Before entering a buy trade, ensure that the MACD indicator is above the zero level and just starting to rise.

Scenario #2: I also plan to buy the euro today if the price tests 1.0386 twice in a row, while the MACD indicator is in the oversold zone. This would limit the pair's downward potential and trigger a bullish market reversal. In this case, the expected upside targets would be 1.0415 and 1.0451.

Sell Signal

Scenario #1: I plan to sell the euro (EUR/USD) after the price reaches 1.0386 (red line on the chart). The target level will be 1.0353, where I plan to exit the market and immediately buy in the opposite direction, expecting a 20-25 pip correction. Selling pressure on the pair may return at any moment, especially if the ECB maintains a dovish stance.

Important: Before entering a sell trade, ensure that the MACD indicator is below the zero level and just starting to decline.

Scenario #2: I also plan to sell the euro today if the price tests 1.0415 twice in a row, while the MACD indicator is in the overbought zone. This would limit the pair's upward potential and trigger a bearish market reversal. In this case, the expected downward targets would be 1.0386 and 1.0353.

Chart Explanation

- Thin Green Line – Entry price for buying the trading instrument.

- Thick Green Line – Estimated Take Profit level or suggested area for locking in profits, as further growth beyond this level is unlikely.

- Thin Red Line – Entry price for selling the trading instrument.

- Thick Red Line – Estimated Take Profit level or suggested area for locking in profits, as further decline beyond this level is unlikely.

- MACD Indicator – When entering the market, it is important to consider overbought and oversold zones.

Important Trading Guidelines

For beginner Forex traders, it is crucial to make careful entry decisions.

- Before the release of key economic reports, it is generally better to stay out of the market to avoid sharp price fluctuations.

- If you choose to trade during high-impact news events, always use stop-loss orders to minimize potential losses.

- Trading without stop-loss protection can quickly deplete your account, especially if you lack proper risk management or trade large volumes.

Key to Successful Trading:

- Have a clear trading plan—similar to the one outlined above.

- Avoid impulsive trading decisions based on short-term market movements.

- Spontaneous trading is a losing strategy for intraday traders.