The current global situation can hardly be described as stable and foreseeable. With natural disasters, armed conflicts, and economic downturns, individuals are compelled to seriously contemplate securing a stable future for themselves, where financial security assumes a pivotal role.

Instances of job layoffs, corporate insolvencies, and inflation have instigated a substantial erosion of trust among citizens in traditional, stable employment with fixed schedules and monthly salaries. Consequently, individuals who were previously proponents of this conventional lifestyle have begun seeking more adaptable alternatives. Many have arrived at the conclusion that salvation lies within the realm of cryptocurrencies for beginners. Here, aspirants for alternative income streams find themselves divided into two groups.

The first group, possessing surplus capital for investment, pondered the question of "how to generate returns through cryptocurrency investments."

On the other hand, the second group—comprising individuals lacking disposable income or unwilling to take financial risks—questioned "how to profit from digital currencies without expertise or initial investments."

At first glance, the approach of the former category seems destined for success. Indeed, prudent actions and a stroke of luck can yield substantial profits from digital assets, sometimes reaching multiples of tens, hundreds, or even thousands of percent.

What underlies such remarkable profitability? The crux lies in the considerable fluctuations in the value of virtual currencies over short intervals. If investors seize the opportune moment to enter the market, significant profits are virtually assured.

Consider Bitcoin, the reigning monarch of the crypto realm, as a prime example. From fall 2020 to spring 2021, its value surged by over 500%, by almost 100% from summer to fall 2021, and culminated in an all-time high exceeding $60,000 in the fourth quarter of 2021.

Consequently, investors fortunate enough to have acquired this premier cryptocurrency at the right juncture witnessed a threefold increase in their investment within a brief timeframe.

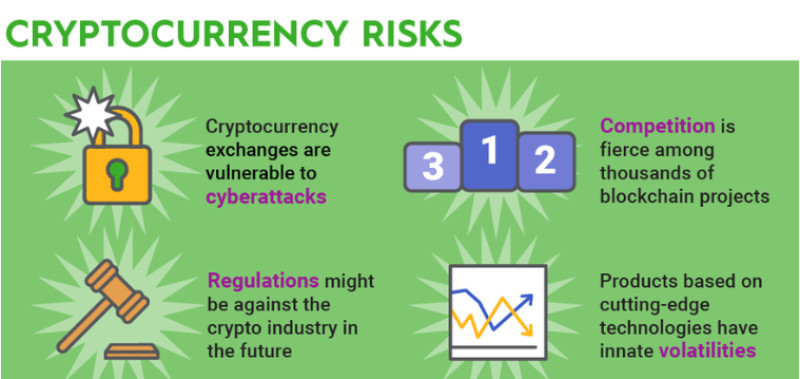

Yet, it is crucial to temper this rosy outlook with a dose of reality. Behind the allure and apparent ease of profiting from digital assets lies a caveat: cryptocurrencies are inherently high-risk, marked by substantial volatility.

This implies that investing in digital assets can yield substantial profits or lead to considerable losses. Consider the following instances.

Last spring, Bitcoin's value plummeted by 30% within a single day. Investors who opted for Terra Luna tokens faced an even graver predicament, with its value plummeting by nearly 100% in less than two weeks.

Considering the aforementioned factors, the rationale behind the second category of individuals—those intrigued by cryptocurrencies—becomes clearer. While they grasp the allure and potential of this asset class, they are unwilling to stake their hard-earned money on virtual currencies, given the absence of guarantees against losses.

Is there a viable avenue for generating income in the realm of cryptocurrencies for such individuals? Undoubtedly! Its name: mining. However, let's delve into this matter step by step. In today's discourse, we shall explore diverse methods for profiting from cryptocurrencies, catering to both those willing to invest in virtual currencies and those hesitant to commit their own funds to this asset class.

What is cryptocurrency?

Before delving into the avenues for profiting from digital currency, it's essential to grasp its essence and mechanics.

How to make money on cryptocurrency constitutes a virtual asset devoid of physical form, existing solely within the digital realm. Put simply, these are virtual coins traversing the globe via the 24/7 connectivity of the Internet.

Rooted in computer-generated code, all facets of cryptocurrencies—from issuance to transfers and transaction processing—unfold exclusively in cyberspace.

You won't find these funds in your wallet or pocket since they lack tangible existence. However, there's a silver lining: digital coins are impervious to tearing or misplacement, unlike their physical counterparts.

Moreover, digital currency facilitates the purchase of goods and services with remarkable ease, a trend that has persisted over time. Another advantage is their seamless conversion into conventional paper currency.

Nevertheless, the disparity between fiat money and digital currency extends beyond the absence of physicality. While the value of traditional banknotes is governed by state and central bank regulations, cryptocurrencies operate within a decentralized framework. They function not under the auspices of a singular authority but through the collective engagement of myriad Internet users.

This decentralized nature affords cryptocurrency owners the autonomy to conduct transactions sans intermediary entities like banks or financial institutions.

This financial autonomy appeals to those wary of governmental oversight of their assets. Additionally, the allure of anonymity draws many to cryptocurrency; transactions can be executed devoid of personal data, addresses, or other identifying information.

In essence, this delineates the crux of digital currencies' emergence and why an increasing number of individuals are exploring avenues to profit from them.

Presently, the majority of virtual coins lack backing from real-world currency quotes or precious metals, with their value hinging solely on the confidence of holders.

Undoubtedly, digital currency boasts numerous advantages, yet translating these theoretical benefits into practical usage is paramount. Before delving into strategies for profiting from cryptocurrency starting from scratch, we invite you to acquaint yourself with the two most prevalent methods for utilizing virtual funds.

- Purchase of goods and services: The acceptance of crypto by businesses is experiencing exponential growth. Remarkably, the inaugural Bitcoin transaction for tangible goods occurred relatively recently, in the early days of 2010. It was then that an American named Laszlo, on a popular crypto forum, proposed exchanging 10,000 digital coins for two pizzas—and followed through! Subsequently, in that same summer, he unabashedly spent over 100,000 bitcoins on pizza.

Initially regarded as either a jest or an innocuous prank, today, settling bills with virtual assets has become commonplace. This normalization owes much to esteemed global entities such as Microsoft, PlayStation, PayPal, Subway, and others, embracing cryptocurrency payments.

Presently, digital coins facilitate the purchase of an array of items: from household essentials to holiday packages, plane tickets, cars, and sports gear.

- Exchange of virtual currency for fiat money: While it's now feasible to pay for a cup of coffee with cryptocurrency at select cafes, it's crucial to acknowledge that this process isn't flawless. Common issues include sluggish transaction speeds and exorbitant fees.

Opting to convert digital assets into fiat currency simplifies matters considerably. This can be achieved through cryptocurrency exchanges, where registration grants the ability to sell coins at any time and subsequently withdraw the equivalent amount in a preferred currency (e.g., dollars, rubles) to a bank card linked to the exchange account.

Another avenue involves utilizing exchangers to convert crypto into physical money. These intermediaries facilitate the withdrawal of funds from the sale of virtual assets to electronic wallets. Some advanced exchangers even offer cryptocurrency conversion via Telegram bots. However, it's essential to note a significant drawback: the often hefty commission fees associated with this method.

*Fiat money refers to a form of currency whose value is determined by the government, lacking backing from gold or other precious metals.

How does cryptocurrency function?

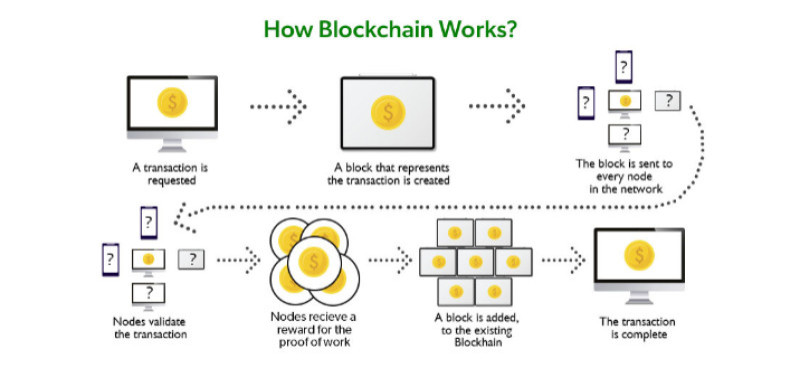

How to make money on cryptocurrency is generated by individuals or organizations, with all transaction data recorded on the blockchain.

The blockchain serves as a platform where users' actions involving digital assets are systematically documented and preserved. Every user has access to the data within the blockchain.

In simpler terms, the blockchain acts as a series of interconnected blocks storing transaction records of digital currency. The integrity and chronological sequence of these blocks are maintained through cryptography.

While users can access the blockchain, they are unable to delete blocks; their capability is limited to adding new ones.

The funds of users within the blockchain network are stored in cryptocurrency wallets. The process of transferring digital assets between wallets is termed a transaction. Each wallet is safeguarded by a private key containing sensitive data, serving as a unique signature for transactions, thereby confirming the approval of cryptocurrency transfers by the wallet owner.

The primary advantages of blockchain technology include:

- Equality

All participants in the blockchain network enjoy equal rights and unrestricted access to transaction records.

- Security

Cryptocurrency transfers are safeguarded by encryption technology.

- Anonymity

Each user's wallet is shielded by a distinct digital code. While it's possible to trace transactions to their originating wallet, identifying the wallet owner remains elusive.

How to profit from cryptocurrency investments

One of the most prevalent methods of earning money with digital assets is through speculation. It seems straightforward: you purchase virtual coins when their value is low, wait for the price to rise, and then sell for a profit. Simple, right? Well, it appears so initially.

However, challenges arise when novice crypto investors attempt to comprehend the reasons behind these fluctuations in asset value.

The intricacy lies in the fact that trading in the virtual assets market differs significantly from trading in securities exchanges or commodities with high volatility.

While experienced investors often capitalize on these differences, earning substantial returns of 100% or even 1,000% on cryptocurrency price disparities within hours, newcomers can face potentially catastrophic losses in such scenarios. What can be done?

Here are several measures to safeguard yourself from losses as you embark on your journey in the virtual assets market.

Fundamental market analysis

This is the main assistant for beginners and not only traders. Most often, within the framework of this method, a specific digital asset is selected, and later, using a large number of factors, it is determined how reliable it is, what advantages and prospects it has.

In addition, using fundamental analysis, you can find out how many cryptocurrency market participants choose this particular asset.

After collecting as much information as possible about the coin you are interested in, try to find a reputable trader who has already dealt with this asset. With this, you will be able to minimize the risks of losing funds due to a cunning fraudulent scheme or the next soap bubble.

If you do not want to seek outside help and decide to choose a cryptocurrency for speculation on your own, check out the list of digital assets for financial investments presented below. In it we have collected the most profitable and promising types of virtual coins that will help you make money on how to make money on cryptocurrency from scratch.

- Bitcoin and its forks. Forks of the king of the digital coin market are coins that work on its basis.

- Altcoins. In simple terms, these are all cryptocurrencies that were created after Bitcoin. They operate on other digital platforms and have features different from the main virtual coin.

- Stablecoins. The exchange rate of these digital assets is pegged to the value of classical currencies (such as the US dollar) or commodity quotes in order to stabilize volatility.

- Tokens. These digital assets are not cryptocurrencies because they do not have their own crypto platforms. However, today investors are increasingly choosing tokens for investment.

Technical market analysis

Technical market analysis comprises a suite of tools designed to aid traders in assessing the current state of the virtual asset market and forecasting its future changes by analyzing statistical patterns in price movements.

This analytical approach enables traders to examine cryptocurrency movements across various timeframes. However, there's a caveat: most technical analysis methods were developed for stable markets.

Given the high volatility characteristic of the virtual currency market, the effectiveness of nearly all technical analysis techniques is limited.

Thus, it's advisable to prioritize fundamental market analysis, while maintaining constant vigilance over coin prices throughout the day remains crucial.

Additionally, crypto traders should always keep an eye on news developments. For instance, the addition of an asset to a new exchange or positive statements made about it in interviews with influential figures can trigger sharp increases in price quotes.

Here are the advantages and disadvantages of trading digital coins

Advantages:

- Potential for lucrative returns in a short timeframe.

- Access to trading digital assets and generating profits around the clock without limitations.

- Limited supply of many coins, ensuring protection against inflation.

Disadvantages:

- Cryptocurrency values often hinge on arbitrary factors unrelated to economics. For instance, Dogecoin, a favorite of Elon Musk, has experienced significant price drops following the businessman's whimsical tweets.

- Lack of regulation by national governments and central banks. This absence of oversight can lead to difficulties in recovering funds lost to fraudulent transactions. Moreover, cryptocurrencies currently exist in a legal gray area, where banks may refuse transfers or demand additional verification.

- Trading in the crypto market necessitates continuous learning and skill development, entailing additional expenses for webinars, expert training, and relevant literature. However, only through ongoing education in this field can one effectively navigate and understand the market.

- High volatility poses a risk, as electronic asset prices can fluctuate unpredictably numerous times within a day.

- Engaging in speculative trading with digital coins carries the potential for losses. Therefore, it's prudent to invest only funds that you can afford to lose.

How to profit from cryptocurrency from scratch, with no investments or experience

If you're keen to profit from cryptocurrencies but hesitant to invest, mining offers a promising avenue. This entails extracting digital currency in a virtual environment.

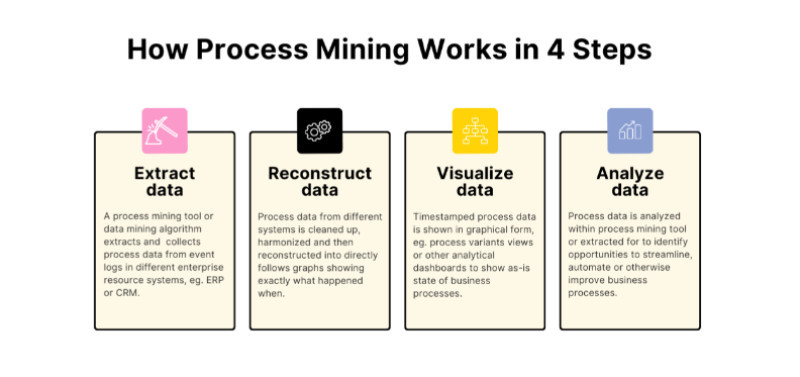

How to make money on cryptocurrency is generated through the resolution of intricate mathematical puzzles using chips embedded in mining equipment. These tasks are formulated by algorithms within specialized action protocols. Each electronic currency type possesses its unique protocol, featuring distinct encryption algorithms.

Forewarning: the mathematical challenges posed by mining devices are a far cry from those encountered in school or university mathematics courses. These are cryptographic problems. Solving them involves deciphering data embedded within information blocks.

Here's the exciting part: upon decrypting one or more blocks, you'll be rewarded with the desired digital coin.

So, where does one begin the mining journey? It starts with acquiring potent equipment or dedicated server storage. Now, let's address the burning question: can you make money in crypto without investing? Unfortunately, no. Obtaining digital data akin to what our typical PCs handle demands more robust equipment. Enter ASIC miners for Bitcoin and graphics cards for altcoins.

Investing in such equipment necessitates initial capital outlay; prices can soar into the thousands of dollars. The silver lining? Technological advancements enable more efficient cryptocurrency mining.

Mining programs operate autonomously; your role is to ensure continuous access to electricity for the equipment.

Once the mining equipment is procured, the next step is installing specialized mining software. Subsequently, the software must be connected to the cryptocurrency network, initiating computational tasks.

With the software fully configured, the next consideration is whether to mine solo or join a pool of miners. Solo mining is challenging, prompting many miners to unite in pools, collaboratively tackling problems. This cooperative effort enhances the likelihood of successful mining outcomes.

And there you have it – you're all set to embark on your mining journey! The installed cryptocurrency mining program will automatically link up with your chosen pool and commence task resolution.

Speaking of mining, here are its main advantages:

- Accessibility: Initially, mining was primarily the realm of programmers, but now, with user-friendly miner programs and abundant guidance on forums, specialized skills are no longer a prerequisite.

- Anonymity: Joining a mining pool only necessitates basic registration, sidestepping the need for disclosing personal information. A mere computer address and cryptocurrency wallet details are ample for initiation.

- Automation: Mining processes are streamlined with dedicated programs, demanding only initial setup responsibilities from users. Subsequent monitoring and periodic maintenance suffice, potentially transforming mining into a dependable income stream when organized meticulously.

Disadvantages:

- Costly Equipment: Cryptocurrency mining mandates high-end equipment, with only the latest ASICs and graphics cards proving economically viable amidst escalating network complexities. Regular equipment updates are essential for sustained profitability.

- Volatility Woes: The erratic nature of digital coin valuations poses significant challenges to miners. Profits hinge on mined cryptocurrencies, yet forecasting their long-term worth remains a formidable task, even for seasoned analysts.

Presently, the landscape is characterized by large-scale miners persisting as long as operational costs remain manageable. Conversely, smaller operators often find themselves compelled to exit due to prohibitive expenses.

Conclusion

Today, we've provided an extensive overview of profiting from how to make money on cryptocurrency in the modern era. While the primary takeaway emphasizes digital assets as a convenient avenue for bolstering savings, it's crucial to acknowledge a significant caveat: virtual currencies constitute a risky asset class, with even seasoned members of the crypto community unable to reliably forecast future price fluctuations.

If you prefer not to constantly monitor digital coin rates and associated developments, consider exploring the segment of our discussion focused on earning cryptocurrency from scratch without financial commitments. Delve into the captivating realm of mining and embark on the journey to acquire electronic currencies independently.

You may also like:

What is Cryptocurrency Used for

What Cryptocurrency is Backed by Gold

When was the First Cryptocurrency Created

Back to articles

Back to articles