Market participants enthusiastically embraced the recent comments from the leaders of the Bank of Japan and actively started buying the Japanese yen.

Initially, the USD/JPY pair sharply declined after reports emerged in the media that the head of the Bank of Japan, Kazuo Ueda, had arrived at the office of Prime Minister Fumio Kishida to discuss potential ways to exit the policy of negative interest rates. This significantly fueled discussions about the Bank of Japan abandoning the regime of negative interest rates sooner than expected. Additionally, the Bank of Japan conducted a special survey of market participants to discuss the impact of such a move and its side effects.

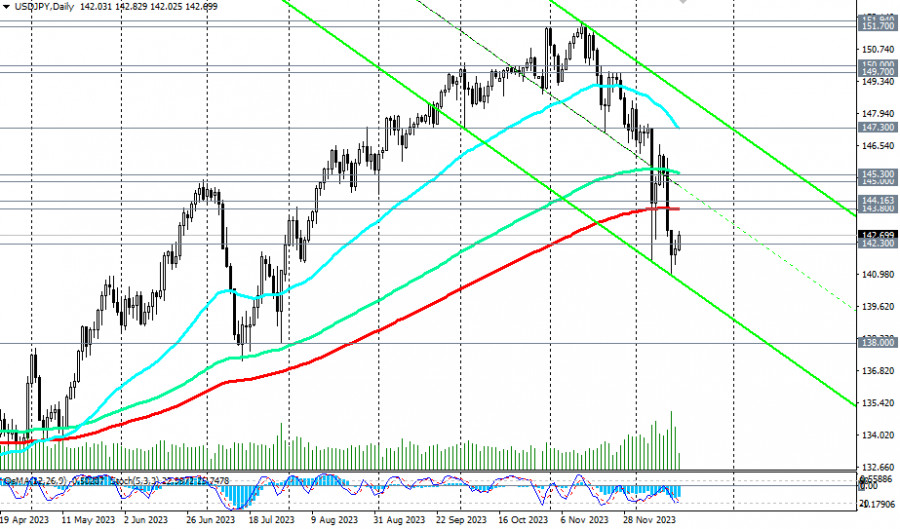

As a result, on December 7, the USD/JPY pair sharply declined, staging a powerful rally of 570 points and dropping to a low since early August at 141.60. After a strong correction (to 146.58), the downward rally of the pair resumed following the publication of U.S. inflation data last Tuesday, indicating further deceleration, and then after the Wednesday meeting of the Federal Reserve amid a sharp weakening of the dollar.

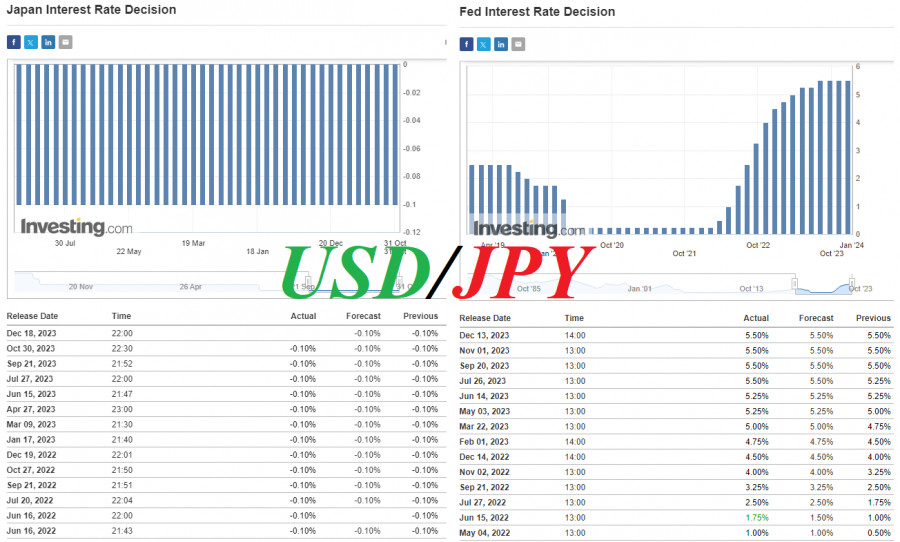

Following this meeting, the interest rate was left at 5.50%, and the fresh Fed forecasts "assume a rate cut of 75 basis points from the current level in 2024," four more times in 2025, and three times in 2026, after which it will stand at 2.00%–2.25%.

Speaking at a press conference after the meeting, Federal Reserve Chairman Jerome Powell emphasized that the central bank's leadership "remains focused on the question of whether rates are high enough."

At the same time, according to him, it is unlikely that the Fed will raise rates further, and central bank leaders "are thinking and talking about when it would be appropriate to lower rates."

The overall decline in USD/JPY in this ongoing month is 550 points at the moment, although volatility has reached 740 points. According to Myfxbook.com, the average monthly volatility of USD/JPY is 527 points, and the result of 740 points speaks for itself.

After reaching a 20-week low at 140.95 last Thursday, today, for the second consecutive trading day, USD/JPY is rising and is trading near 142.70 as of writing.

Despite this rise, many economists believe that the yen could strengthen even more next year, provided that the Bank of Japan indeed begins to act towards winding down its long-standing ultra-loose policy.

As known, following the recent October meeting, the members of the Bank of Japan's board decided to leave the current parameters of monetary policy unchanged, maintaining the interest rate and the yield of 10-year Japanese government bonds at levels of -0.10% and 0%, respectively.

Ueda stated in the accompanying statement that it was advisable to make YCC policy more flexible, considering the very high uncertainty in the economy and markets. He mentioned that during market operations, the upper limit of the yield on 10-year JGBs at 1% would be considered a reference point. Additionally, he conveyed that the Bank of Japan would patiently continue to ease monetary policy under YCC to support economic activity and create conditions for more active wage growth during a press conference following the central bank's meeting.

Now, economists predict that the Bank of Japan will end the YCC policy as early as the January meeting, which could strengthen expectations of further policy tightening in 2024.

At present, the USD/JPY pair maintains a general upward trend, and the previous decline can be attributed to the attempt by yen buyers to break it.

From a technical standpoint, USD/JPY has only made the initial attempt to break free from the grip of its buyers, testing the crucial support level of 143.80 that separates the medium-term bullish market from the bearish one.

Despite a relatively deep decline into the zone below this key level (by 285 points), the long-term upward trend of the pair is still intact.

However, once expectations of a trend reversal intensify, there is a risk of a more abrupt and stronger movement.

In the near future, we will likely gain insights into what to expect from the Bank of Japan in 2024 and its early months, as the central bank meeting is scheduled for tomorrow.

It is widely expected that the current parameters of the Bank of Japan's monetary policy will remain unchanged. However, some economists believe that changes to its key parameters will be made at the meeting on January 22–23 against the backdrop of rising wages (averaging 3.58%, the largest increase in about three decades).

Most economists believe that the Bank of Japan will conclude the cycle of ultra-loose monetary policy by the end of 2024, which is still a dovish factor for the yen.

If the market's expectations regarding the start of the unwinding of the Bank of Japan's ultra-loose policy align with expectations of a shift in the vector of the Fed's monetary policy, the downward movement of USD/JPY will intensify.

A re-entry of the price below the 141.00 mark and a break below the local support level of 138.00 may trigger further declines in USD/JPY, confirming negative expectations for the pair.

It is worth noting that the Bank of Japan's interest rate decision will be published on Tuesday after 01:00 (GMT). The Bank of Japan press conference will begin after 05:00 (GMT).