Deja Vu for Investors

Financial markets greeted Donald Trump's second inauguration with mixed emotions. On the one hand, shareholders were enthusiastic about the pro-business agenda he was pushing. On the other hand, the currency market froze in anticipation after he said he might impose new tariffs in the coming weeks.

Dollar Rises on Threat Wave

The tariff situation has caused sharp swings in the dollar. After initially declining on expectations that the tariffs would not go into effect immediately, the American currency has strengthened sharply. This came as Trump announced plans for a 25% tariff on imports from Canada and Mexico from February 1.

The US dollar hit a five-year high of 1.452 Canadian dollars before falling back to 1.44. However, against the Mexican peso, it remained below its November peaks.

Volatility as the new normal

The current market swings have reminded investors of the turbulent times of Trump's first term. However, analysts say that stock market players are now showing more restraint and are less likely to panic.

US Treasury yields rose, while stock futures returned to their starting positions after a brief jump. Thus, Nasdaq futures fell by 0.08%, while S&P 500 futures added only 0.07%.

European markets are down

European markets also responded with a decline. EUROSTOXX 50 futures fell 0.25%, while the FTSE fell 0.02%. The region's currencies also came under pressure, with the euro and pound sterling losing around 0.3%.

Japanese Yen: An Island of Stability

Amid market turmoil, the Japanese yen strengthened its position. Market participants bet on the Bank of Japan's monetary policy tightening, despite concerns about the possible impact of US tariffs on the Japanese auto industry.

Donald Trump's second inauguration demonstrated familiar dynamics: volatility and increased investor attention to policy decisions. However, markets are showing that they are ready to adapt, albeit with a restrained reaction to loud statements.

Nikkei: Cautious Growth

Japan's Nikkei index (.N225) showed indecision, balancing between losses and modest gains. On the day, it rose 0.13%, reflecting the general caution of investors in the face of global uncertainty.

Cryptocurrencies: Meme Coin Rise and Bitcoin Records

Amidst the political news, an unexpected leader has emerged on the crypto market — a meme coin associated with the image of Trump. Its market capitalization has exceeded the $10 billion mark, giving a positive impulse to the entire cryptocurrency market.

Bitcoin, the largest digital currency, soared to a new record of $109,000, although it later rolled back to just below $102,000. This rise demonstrates the growing interest of investors in digital assets as a risk hedging tool.

China and Hong Kong: The calm before the storm?

Hong Kong stocks remained stable, and the yuan maintained its overnight gains. The lack of immediate tariffs from the United States on Chinese goods allowed the markets of the Middle Kingdom to breathe a sigh of relief for a while. However, experts emphasize that Trump's strategy for trade negotiations with China seems to be repeating the experience of his first term.

Analysts on Canada, Mexico, and China

Naka Matsuzawa, a macro strategist at Nomura, said Trump likely views Canada and Mexico not as direct competitors, but rather as conduits for Chinese exports. "Tariffs on Canada and Mexico may just be part of a trade strategy," he said.

Challenges to a New Agenda

Trump has kicked off his second term with an ambitious agenda of trade reforms, tax cuts, immigration, and deregulation. These initiatives could boost corporate profits, but the risks of rising inflation and higher interest rates remain.

Energy in Focus

In his inaugural address, Trump reaffirmed his commitment to supporting the U.S. oil, gas, and energy industries, calling them "key to economic recovery." He also announced plans to raise significant amounts of money in tariffs, reigniting speculation about his protectionist policies.

Balancing Toughness and Flexibility

Despite the tough rhetoric, investors have seen signs of a more measured approach to economic issues from the new administration, raising hopes that Trump's second term will be more predictable for global markets than his first.

Banking Sector on the Rise

Donald Trump's promises to ease economic regulation have galvanized financial markets, especially the banking sector. Shares of major financial institutions have soared, helped by comments from Wall Street CEOs. In their earnings reports, they expressed confidence that the new administration will be a reliable partner for businesses.

Trump and the Crypto Market: High Expectations

The cryptocurrency industry, which has long viewed Trump as a supporter of digital assets, is optimistic about his second term. Among the announced initiatives are the creation of a federal reserve for bitcoin, easier access to banking for crypto companies, and the formation of a specialized cryptocurrency council. These steps could bring the crypto industry to a new level of legitimacy.

However, the launch of Trump's signature cryptocurrency, which reached a market capitalization of $8 billion in just one day, has caused a mixed reaction. Many analysts are wondering: how ethical is such a move, given its impact on the market?

Bitcoin: Records and Rollbacks

After Trump's inauguration speech, Bitcoin remained in a highly volatile zone. Despite the overnight peak of $109,071, it corrected to $102,000. This market movement is explained by the disappointment of investors who were expecting more specific statements from the president regarding cryptocurrency policy.

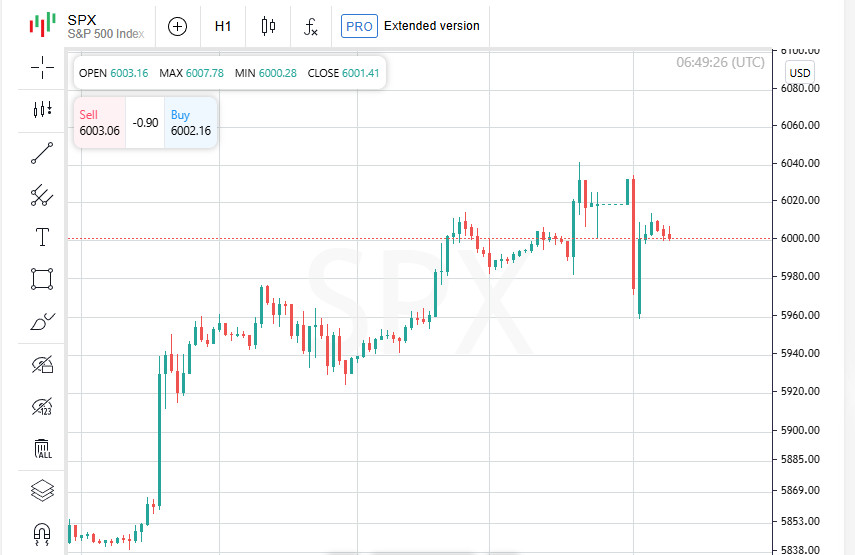

S&P 500 Volatility: History Repeating Itself?

The experience of Trump's first term shows that markets are capable of significant growth despite periodic shocks. For example, during the first year of his presidency, the S&P 500 index grew by 19.4%, and over the entire term - by almost 68%. However, this growth was accompanied by sharp jumps in volatility, caused, in particular, by the trade war with China.

The current situation also promises to be dynamic. After the 2017 inauguration, the S&P 500 index added 0.3% per day, and many market participants are waiting to see how events will unfold this time. Since Monday falls on a holiday, the market reaction will not be clear until Tuesday.

A new chapter or a repeat of the same script?

Trump's second term begins with big promises and high expectations from investors. Easing regulations, supporting businesses and cryptocurrencies, as well as the desire to stimulate the economy through deregulation and tax cuts create the ground for growth. However, the ongoing risks of volatility and trade conflicts remain the main challenge for financial markets.

Investors ask: "How exactly?"

Markets continue to demonstrate caution despite Donald Trump's big promises. The main question that worries investors is "how": how will the administration cut spending, reduce inflation and interest rates?

"The most important thing now is to understand how Trump's promises will be implemented," said Josh Strange, president of Good Life Financial Advisors from NoVA.

Treasury bonds: yields are falling

US Treasury bonds are showing mixed movements. The 10-year yield fell 6.7 basis points to 4.5440%, while the two-year yield fell 4.7 basis points to 4.2255%. The decline reflects a growing appetite for safe havens amid uncertainty.

Dollar and other currencies: cautious recovery

In the currency market, the dollar managed to recoup its morning losses, moving away from a two-week low. The euro fell 0.3% to $1.0385, while sterling weakened 0.32% to $1.2290.

China: trade threats and caution

Investors in China are anxiously assessing the possible impact of Trump's plans to impose high tariffs. Despite threats to raise tariffs on Chinese imports by up to 60%, the lack of immediate action has allowed markets to remain relatively calm.

The blue-chip CSI300 index fell 0.13%, while the Shanghai Composite fell 0.35%. These figures reflect the cautious nature of market participants, who are not in a rush to make decisions amid political uncertainty.

Hong Kong: A bright spot in Asian markets

Amid general volatility in regional markets, Hong Kong's Hang Seng Index managed to gain 0.42%. Its gains were a catalyst for the broader MSCI Asia-Pacific ex-Japan index, which rose 0.34%.

Volatility remains the main theme

Despite some recovery, global markets remain in a holding pattern. Investors are waiting for more concrete actions from the Trump administration to assess the real impact of his economic policies. Expectations are high, but uncertainty still dictates caution.

Oil prices under pressure

Oil prices fell significantly after Donald Trump announced plans to maximize oil and gas production in the United States. The president announced that he would declare a state of emergency to accelerate the development of the energy sector and reduce dependence on imports.

Brent crude futures fell to $80.18 per barrel, close to a one-week low. American WTI crude also showed a decline, falling by 1.46% to $76.74 per barrel. The decline comes amid fears of oversupply, which is forcing investors to revise their forecasts.

US energy policy

Trump's decision to increase oil and gas production underlines his priorities in economic policy. Calling for complete energy independence for the United States has long been part of his program, but the current move could have long-term consequences for the world market, especially if supply exceeds demand.

Gold Back in Focus

With oil prices falling and financial markets generally uncertain, gold is back in the spotlight. The spot price of the precious metal rose 0.5% to $2,722.01 per ounce, indicating that market participants are seeking safe havens amid volatility and geopolitical tensions.

The markets' reaction to Trump's emergency declaration highlights their sensitivity to changes in energy policy. If U.S. oil production increases and demand fails to catch up with supply, oil prices could remain under pressure. At the same time, the rise in gold suggests that investors are becoming more cautious as they await clearer signals from the administration.

The situation in commodity markets remains volatile, and the impact of Trump's new initiatives, as always, is controversial among analysts.