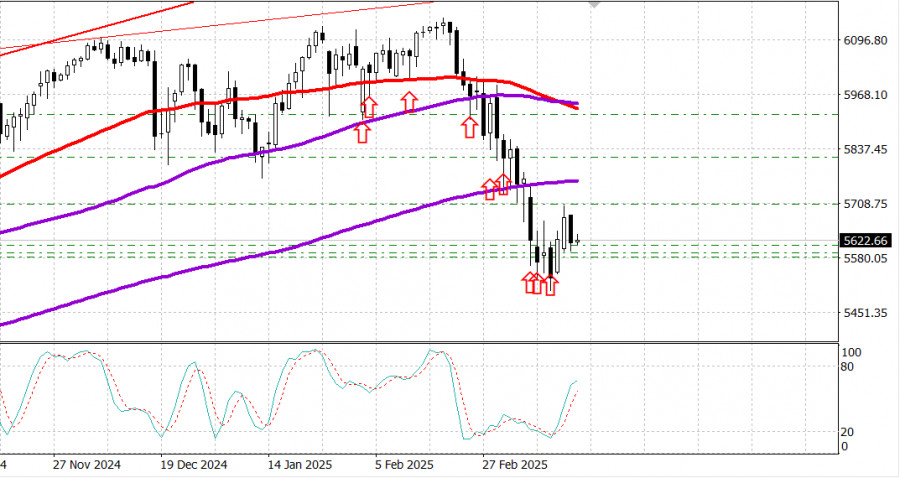

S&P 500

Market overview on March 19

US Market: Pullback. Consolidation. Focus on Fed.

Major US indices on Tuesday: Dow -0.6%, NASDAQ -1.7%, S&P 500 -1.1%, S&P 500 5,614, range 5,500 – 6,000.

The stock market closed with losses across all sectors.

Key indices closed near session lows, declining by 0.6% - 1.7%. The downward movement followed two consecutive winning sessions for the S&P 500 (-1.1%) and the Nasdaq Composite (-1.7%), but the previous gains were not entirely erased.

The S&P 500 and Nasdaq Composite remain 1.7% and 1.2% higher than last Thursday's close, respectively.

Large-cap stocks led the decline, including Tesla (TSLA 225.31, -12.70, -5.3%), NVIDIA (NVDA 115.52, -4.00, -3.4%), Meta Platforms (META 582.36, -22.54, -3.7%), and Alphabet (GOOG 162.67, -3.90, -2.3%).

Investors were processing a series of NVIDIA-related news following its public event, but the stock seemed unaffected by the announcements.

Meanwhile, Alphabet announced the acquisition of Wiz, Inc., a cloud security platform developer, for $32 billion.

Geopolitical risks were also cited as a factor affecting the market's decline. However, commodity prices and Treasury bond movements did not reflect this concern.

Treasury bonds are considered a safe haven during geopolitical crises, but the yield on 10-year bonds fell by 3 basis points to 4.28%, and the 2-year bond yield dropped by 1 basis point to 4.04%, showing only modest changes.

Oil prices often rise when Middle East tensions escalate due to supply disruption concerns. However, WTI crude oil futures fell 1.2% yesterday to $66.78 per barrel.

A call between President Trump and Russian President Putin also had little influence on stocks and bonds. White House Press Secretary Carolyn Levitt released the call transcript, stating that the leaders agreed that the path to peace begins with an energy and infrastructure ceasefire, followed by technical talks on implementing a maritime ceasefire in the Black Sea, a full ceasefire, and a permanent peace agreement.

It was evident that Trump was deeply disappointed and felt misled in his expectations from the conversation. Despite Moscow's positive statements, Trump canceled his planned speech immediately after the call. Additionally, Trump usually reacts quickly on his social network, but this time, his response was significantly delayed.

It seemed that Trump expected a full ceasefire commitment during the call, which did not happen. This was seen as an unexpected failure for Trump, especially since his personal envoy Withoff had met with top Russian officials in Moscow just before the call and had spoken for several hours, suggesting that the key negotiation details should have already been agreed upon.

The Moscow Exchange Index fell by 1% the morning after the US-Russia call. It was a moderate decline but one that reflected Russian investors' true reaction to the conversation's outcome.

Economic data released yesterday was mixed: housing starts increased in February, while import and export prices signaled inflationary shifts compared to last year.

Year-to-date performance:

Dow Jones Industrial Average: -1.7%

S&P 500: -4.5%

S&P Midcap 400: -5.6%

Nasdaq Composite: -9.4%

Russell 2000: -8.1%

Economic data review:

Housing starts in February: 1.501 million (consensus: 1.385 million)

Previous figure was revised to 1.350 million from 1.366 million

Building permits in February: 1.456 million (consensus: 1.450 million)

Previous figure was revised to 1.473 million from 1.483 million

Key takeaway: Housing starts rebounded thanks to improved weather, reflected in an 18.3% increase in the Southern region, which saw a 23% decline in January.

February export prices: +0.1% (previous: +1.3%)

February export prices excluding agriculture: +0.1% (previous: +1.5%)

February import prices: +0.4% (previous: revised from +0.3% to +0.4%)

February import prices excluding oil: +0.3% (previous: +0.1%)

Industrial production in February: +0.7% (consensus: +0.2%)

Previous figure was revised from +0.5% to +0.3%

Capacity utilization in February: 78.2% (consensus: 77.7%)

Previous figure was revised from 77.8% to 77.7%

Key takeaway: Industrial production showed strong growth, mainly thanks to an 8.5% surge in automobile and parts production, likely in anticipation of new tariffs.

Vehicle production jumped 11.5% from the previous month, reaching a seasonally adjusted annual rate of 10.35 million units.

Macroeconomic data slated for release on Wednesday:

07:00 ET: MBA Weekly Mortgage Index (previous: +11.2%)

10:30 ET: Weekly crude oil inventories (previous: +1.45 million barrels)

16:00 ET: January net TIC flows (previous: $72.0 billion)

Additionally, the March FOMC decision will be announced at 2:00 ET.

Note:

The Fed is unlikely to change rates, but the wording of the statement will be crucial.

Energy:

Brent crude oil: $70.20. Oil dropped by about $1 amid renewed US market weakness.

If the US market decline continues, oil could fall below $70.

Conclusion:

The Fed is expected to keep rates unchanged, but its economic outlook statement should be analyzed carefully.

The US stock market is currently at a support level and it has pulled back close to it, making it a potential buying opportunity. Cautious buying is recommended.

Mikhail Makarov

More analytical articles:

https://www.instaforthtex.com/ru/forex_analysis/?x=mmakarov

https://www.ifx.consulting/ru/forex_analysis/?x=mmakarov