The GBP/USD currency pair experienced a sharp decline on Thursday. Anyone with a basic understanding of the forex market and who closely monitors market developments could see that the British pound was likely to fall. Typically, the outcomes of central bank meetings are anticipated, and market participants price them in ahead of time. However, this is not always the case.

If the Bank of England was expected to lower interest rates and maintain a non-hawkish stance, it would be logical to expect selling pressure on the pound. Surprisingly, the market did not foresee this, as the pound had been rising throughout the week. As a result, the market failed to factor in the BoE's rate cut decision. Once the rate cut was officially announced, the British currency plummeted—a logical and predictable reaction.

Nevertheless, the broader market context remains complex. Three weeks ago, an upward correction began for the pound on the daily timeframe, but it still appears weak. The pound's declines on Monday night and Thursday seem inconsistent with this overall technical picture. Corrections in the market are often erratic and uneven. Even without delving into upcoming macroeconomic data and events, it's reasonable to assume that the pound may resume growth either today or next week. However, this is not a guaranteed outcome. If today's U.S. macroeconomic data exceeds expectations, the dollar could strengthen further, prolonging and complicating the correction for the pound. If the market continues to receive positive news for the dollar, the four-month downtrend may likely resume, despite such a brief correction.

The BoE has decided to cut the key interest rate, with all nine members of the Monetary Policy Committee voting in favor of this decision. Markets had expected only eight votes for a rate cut. While this discrepancy is minor, the outcome was even more dovish than anticipated. Andrew Bailey's comments following the meeting were of little interest at that moment. However, it is noteworthy that the BoE downgraded its 2025 economic growth forecast from 1% to 0.75%, adding yet another negative factor for the pound.

Additionally, the BoE projects that inflation will rise to 3.7% in the second half of the year, citing global energy prices as a contributing factor. On one hand, this could positively impact the pound, as it raises the possibility of slower monetary easing in the UK. On the other hand, with an underperforming economy, the BoE may still need to continue cutting rates. Meanwhile, the market has only priced in the BoE's confirmed easing measures, whereas the entire Federal Reserve easing cycle was already priced in between 2022 and 2024, with some cushion for adjustments. Thus, we still do not see any fundamental drivers for sustained growth of the pound in the medium term.

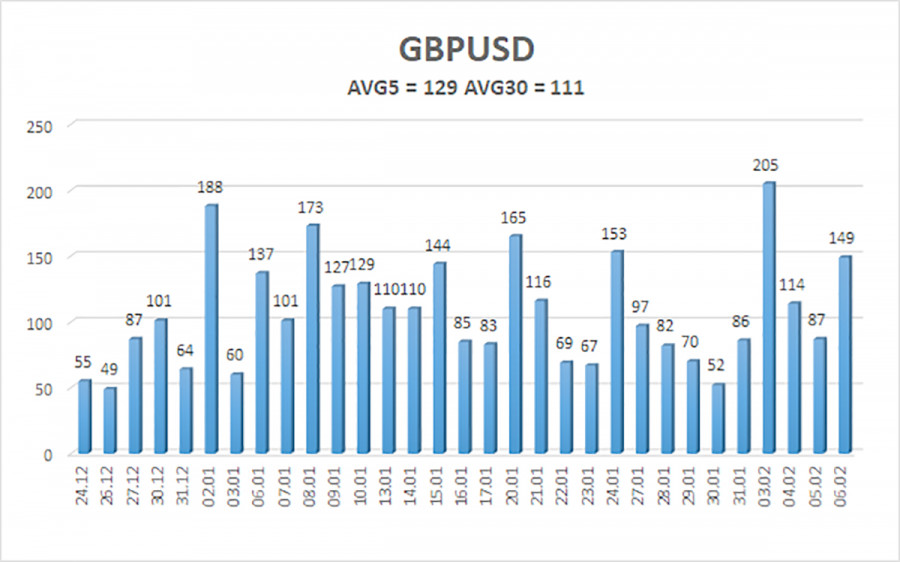

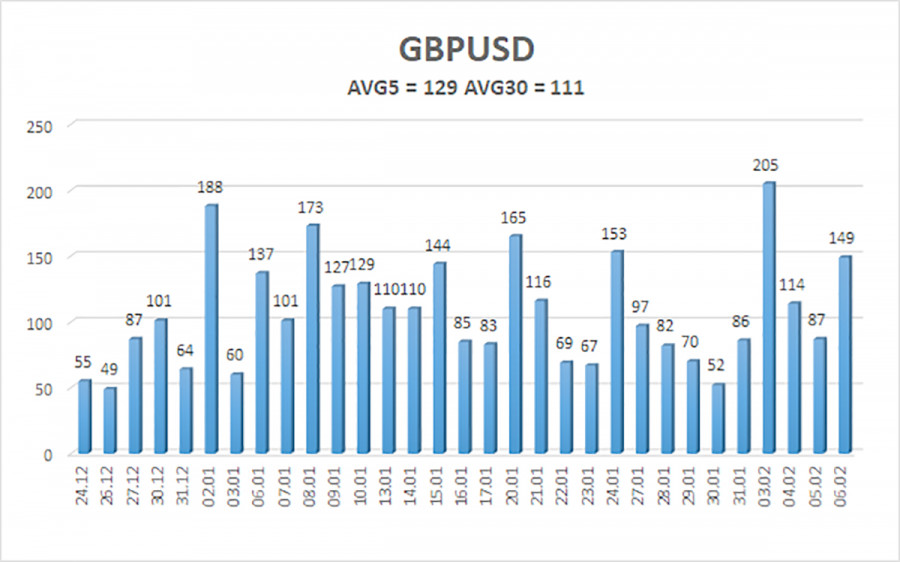

The average volatility of the GBP/USD pair over the last five trading days stands at 129 pips, which is classified as "high" for this currency pair. On Friday, February 7, we expect the pair to move within the range defined by 1.2305 and 1.2563. The higher linear regression channel remains downward-sloping, signaling a continuation of the bearish trend. The CCI indicator previously entered the oversold zone, warning of a potential new wave of upward correction.

Nearest Support Levels:

S1 – 1.2390

S2 – 1.2329

S3 – 1.2268

Nearest Resistance Levels:

R1 – 1.2451

R2 – 1.2512

R3 – 1.2573

Trading Recommendations:

The GBP/USD pair is currently in a medium-term downtrend. We believe that long positions are not advisable at this time, as all potential bullish factors for the British pound have likely been priced in multiple times, and no new catalysts for growth have emerged.

For traders who rely solely on technical signals, long positions could be considered if the price moves above the moving average, with target levels set at 1.2563 and 1.2573. However, short positions remain more relevant, with initial target levels at 1.2307 and 1.2268. It is essential for the price to confirm the end of the daily timeframe correction before entering any new sell trades.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.