The EUR/USD currency pair lost over 300 pips on Wednesday and Thursday, but Friday brought a strong recovery. No one would have been surprised if the dollar had continued falling on Friday. The market continues to react selectively to news, events and reports favoring the dollar, and Friday's macroeconomic data from the U.S. was somewhat mixed. On the one hand, the number of NonFarm Payrolls was significantly above expectations, but on the other hand, the unemployment rate rose to 4.2%, which no one had forecast.

In general, the market remains in turmoil. Given the abundance of recent events — some highly significant — it's extremely difficult to determine what the market has already priced in, what it's still processing, and what currently matters. Making any forecast at this moment is a challenging and unappreciated task. As expected, Trump introduced new tariffs on April 2, and over the weekend, he added another one — on all imported beer. The U.S. president is not planning to stop. Many experts now say that Trump is going "all in." Either he will radically reshape the global trade system in favor of the U.S., or he will face complete failure — and the blame, he says, will lie with other countries or Jerome Powell.

Speaking of Powell, on Friday, he again stated that the Federal Reserve does not plan to cut rates anytime soon, as it will take considerable time to assess the impact of tariffs on the economy. The Fed Chair also noted that Trump's tariffs will undoubtedly lead to higher inflation (which makes rate cuts even less appropriate) and a rise in unemployment. Powell once again emphasized that the Fed's primary goal is price stability. In our view, this was the strongest possible message to Trump.

Effectively, the Fed Chair clarified that the central bank is not concerned with the president's initiatives. If Trump wants to impose tariffs on the entire world based on his vision of order, he is free to do so. But why should the Fed — an independent body — be responsible for mitigating the consequences of these actions? If the U.S. economy starts slowing sharply, it will be clear who is accountable. If the Fed begins stimulating the economy by cutting rates, inflation will rise even further, and the central bank will fail to achieve its targets. If inflation is high, the Fed gets blamed; if the economy contracts, the president and government are at fault. In this way, Powell once again drew a clear line of responsibility. We'll see how American consumers react to the sharp rise in import prices. Protests against Trump are already being planned across the country.

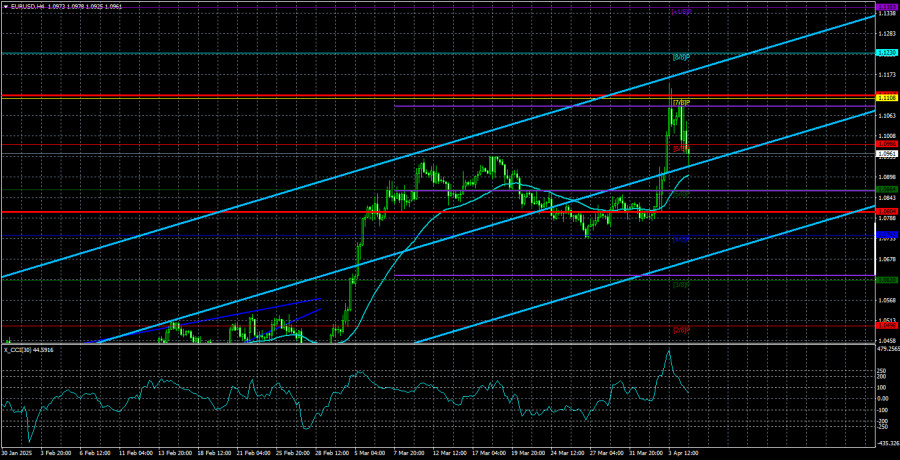

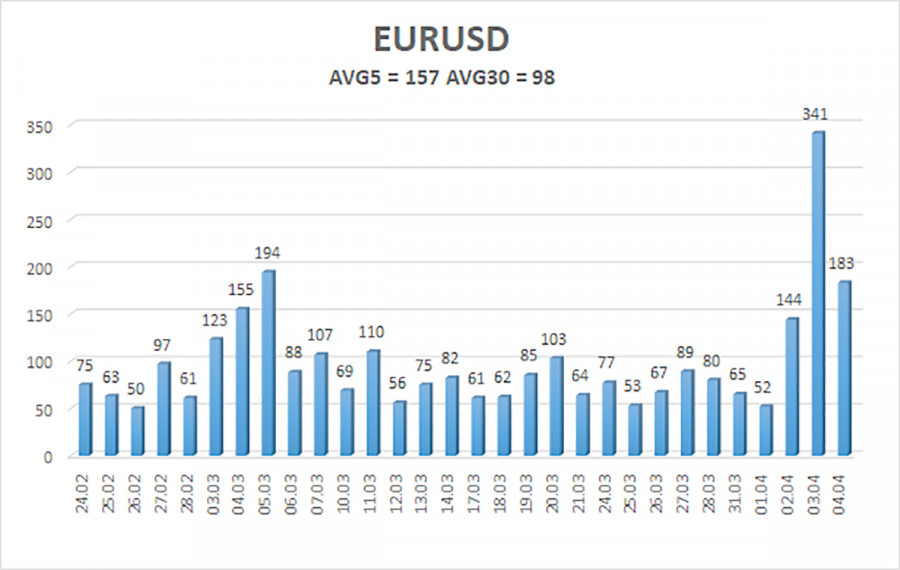

The average volatility of the EUR/USD pair over the past five trading days as of April 7 stands at 157 pips, which is considered "high." We expect the pair to move between the levels of 1.0804 and 1.1118 on Monday. The long-term regression channel is pointing upward, indicating a short-term bullish trend. The CCI indicator entered the overbought zone, signaling a possible correction, but the trend remains bullish for now.

Nearest Support Levels:

S1 – 1.0864

S2 – 1.0742

S3 – 1.0620

Nearest Resistance Levels:

R1 – 1.0986

R2 – 1.1108

R3 – 1.1230

Trading Recommendations:

EUR/USD continues its upward movement, which is now becoming a trend. For months, we've been saying we expect the euro to decline in the medium term, and so far, that outlook hasn't changed. The dollar still has no reason for a medium-term decline — except for Donald Trump. Yet that single factor continues to drive the dollar into the abyss. This situation is unprecedented and quite rare for the FX market. Short positions remain attractive, with targets at 1.0315 and 1.0254, but it's currently very difficult to predict when the Trump-driven rally will end or how many more tariffs and sanctions the U.S. president will impose. If you trade purely on technicals, long positions can be considered as long as the price remains above the moving average, with targets at 1.1108 and 1.1230.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.